[ PHOENIX ] — A new policy paper from the Grand Canyon Institute — a nonpartisan, nonprofit organization dedicated to informing and improving public policy in Arizona through evidence-based, independent, objective, nonpartisan research — finds that Arizona’s debt protection policies “leave families who owe money at risk of financial calamity.”

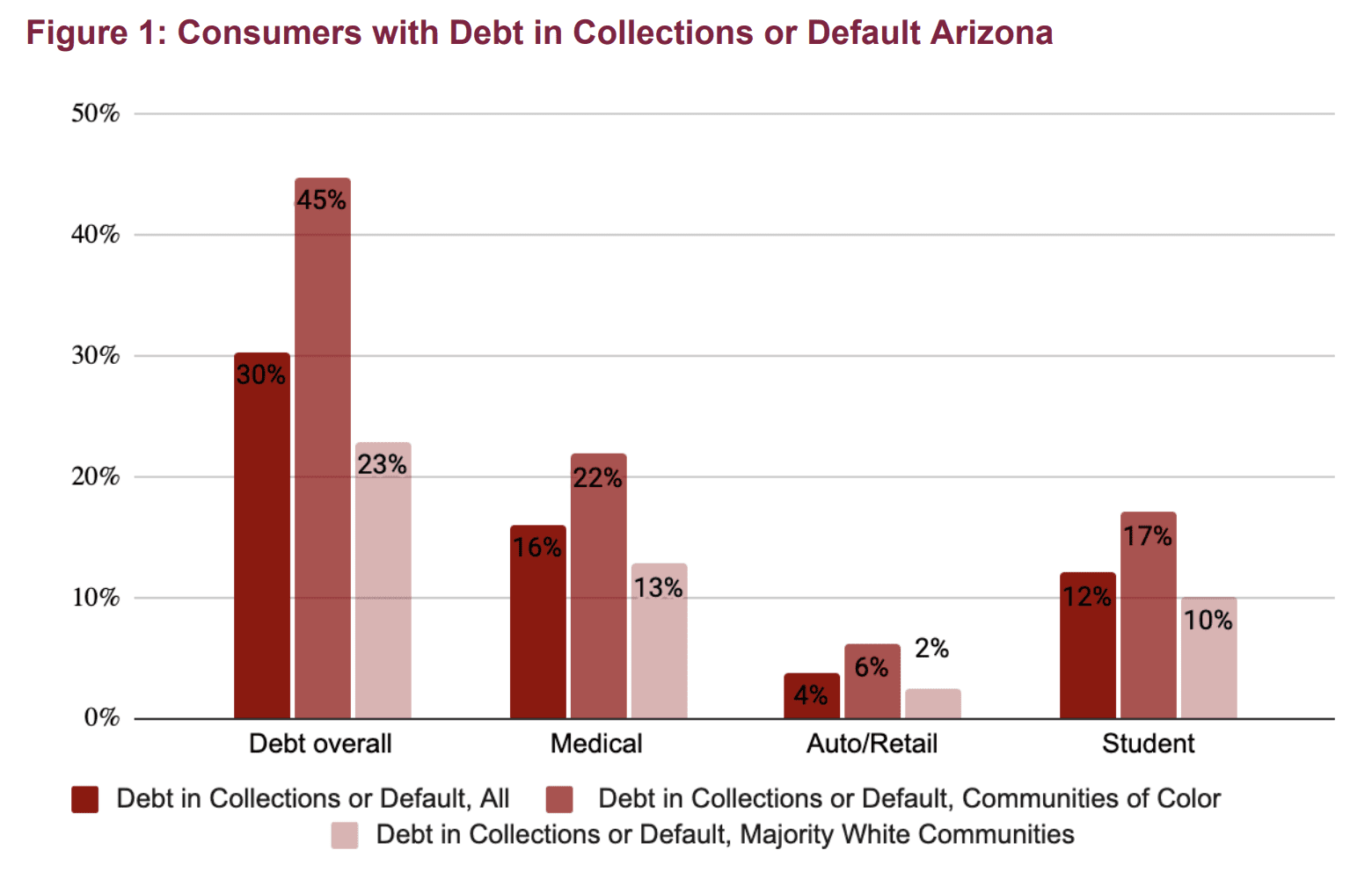

(Source: Grand Canyon Institute, 2022, using data from Urban Institute, 2021.)

30% of Arizonans have debt in collections, which is slightly higher than the national average. This problem isn’t equal — the study’s authors point out that among Arizona’s communities of color, the rate increases to 45%. Despite so many Arizonans struggling with debt, our state’s exemption laws received an overall rating of “D” from the National Consumer Law Center.

According to the report, Arizona’s current laws are particularly bad at protecting:

- Weekly Wages. Our current laws offer very little protection for Arizonans’ hard-earned paychecks. In the words of the report’s authors, “Arizona law only protects the federal minimum amount (30 x the federal minimum wage) in a work week; however the state allows for a reduction of amounts garnished in cases of hardship. The NCLC rates Arizona a D for its current protection of wages.”

- Bank Accounts. According to the study, “Arizona only protects $300 in a bank account from garnishment which earns it a D grade from NCLC.” That’s barely enough to cover a few weeks of groceries or an electricity bill during the summer.

- Household goods. Right now, goods like beds, washers, tables, and refrigerators are only protected up to $6,000. Debt collectors can seize these essential items, leaving everyday people scrambling to find ways to sleep or eat in their own homes.

The report also finds that our initiative — the Predatory Debt Collection Protection Act — would go a long way towards protecting struggling families in these three key areas. If the initiative were to pass, Arizonans would be able to keep 90% or more of their paychecks, $5,000 in their bank account, and $15,000 of household goods — boosting Arizona’s overall rating to a “B”. That means Arizonans with debt could stay on top of their bills and maintain the stability everyone needs to hold down a job and support their family.

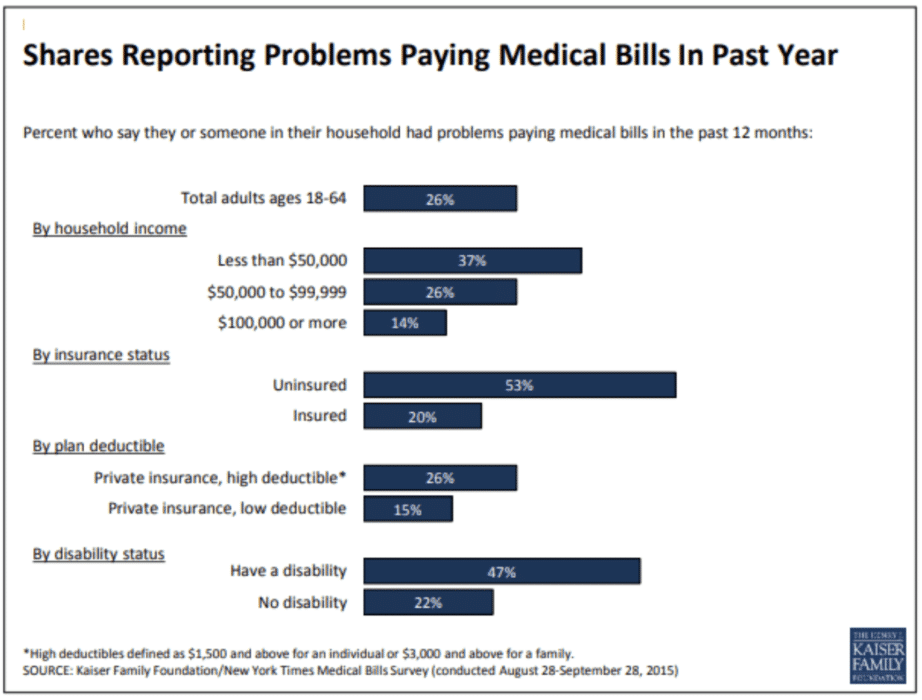

Another major finding from the report is the high rate of medical debt in our communities. While 16% of Arizonans have medical debt in collections, many debts are currently unreported or recorded as credit card debt. That means that the true number of Arizonans struggling with medical debt is likely significantly higher than 16%. In fact, one-in-four adults have reported trouble paying medical bills — with half of those struggling reporting that medical bills have caused “severe problems with their finances.”

The authors find that by limiting the interest rate on medical debt and providing protection for assets, the Predatory Debt Collection Protection Act could help, “stave off bankruptcy for those burdened by medical debt, particularly given the unforeseen nature of medical emergencies and accumulating costs of more persistent healthcare needs.” It’s clear that the scale of medical debt in Arizona is greater than previously understood — and that this initiative can help.

Taken together, Arizona’s current laws can put someone into a pit of debt that’s impossible to climb out of. Afterall, how can a family pay for the childcare they need to go to work when they’re struggling to make ends meet? How can someone succeed at their job when debt collectors can take the washing machine they need to have clean clothes? How can someone struggling with a chronic health condition pay back medical debt when interest rates can balloon to 10%?

That’s why we’re taking a stand against predatory debt collection practices. Join us to put the Predatory Debt Collection Protection Act on the ballot and get Arizona families the protections they deserve.

You can read the full report from the Grand Canyon Institute here.

###

Paid for by Healthcare Rising Arizona. Not authorized by any candidate.